HB 1061: Voluntary Income Declaration, Recovery and Amnesty Scheme Bill, 2017

Download Bill Bill Analysis Download Bill Analysis Infograph

Sponsor:

Hon. Okorie Linus Abaa

State:

EBONYIParty:

Peoples Democratic PartyBill Status: First Reading

- First Reading: 13/06/2017

- Second Reading:

- Committee Referred To:

- Consolidated with:

- Date Reported out of Committee:

- Third Reading:

- Reconsidered and Passed:

Bill Analysis:

SHORT TITLE

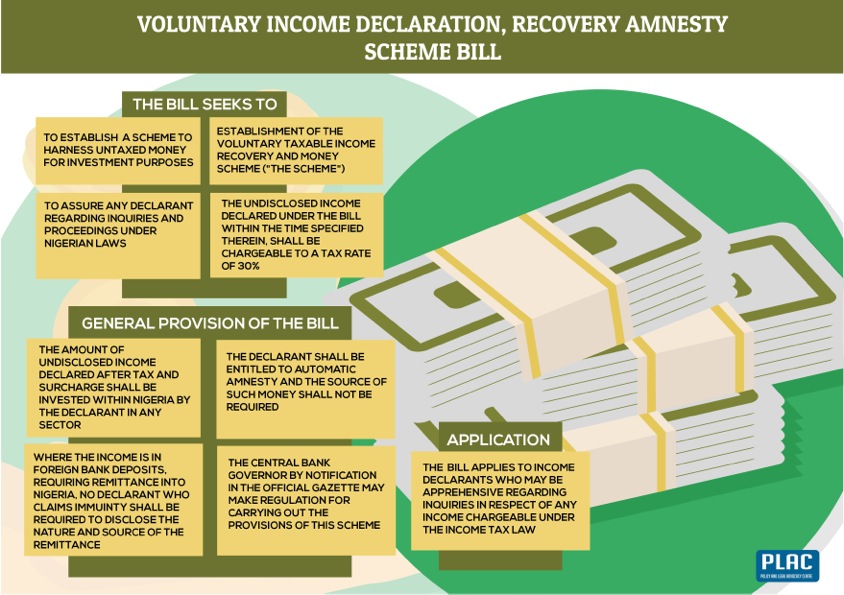

Voluntary Income Declaration, Recovery and Amnesty Scheme Bill

OBJECTIVE OF THE BILL

The objectives of the Bill are to:

- Establish a scheme to harness untaxed money for investment purposes;

- Ensure amnesty for any person who declares an undisclosed income under the Scheme to be established under the Bill (when it becomes law);

NUMBER OF CLAUSES/PARTS

The Bill has 24 Clauses including citation and interpretation.

APPLICATION

The Bill applies to income declarants who may be apprehensive regarding inquiries in respect of any income chargeable under the Income tax law

GENERAL PROVISION

1. Establishment of the Voluntary Taxable Income Recovery and Money Scheme (“the Scheme): -

The Bills seeks to establish a scheme to be known as Voluntary Income Recovery and Amnesty Scheme (“the Scheme”). The Scheme shall come into force on such a date, as the Federal Government shall specify by notification in the Official Gazette. The Central Bank of Nigeria shall implement the Scheme (Clause 1).

2. Declaration of Undisclosed Income: -

Subject to the provisions of the Scheme, any person may make, on or after the date of commencement of the Scheme but before a date to be notified by the Central Bank in an Official Gazette, a declaration in respect of any income chargeable under the Income tax Law for any assessment prior to the passage of this Bill into law:

- which he failed to furnish or disclose under the income tax law

- which he failed to disclose or return under any law in operation before the commencement of the Scheme;

- which he has escaped assessment by reason of the omission or failure on the part of such person to fully disclose all material facts necessary for the assessment of such income

Where the income chargeable to tax is declared in the form of investment in any asset, the fair market value of such asset as on the date of commencement of the Scheme shall be deemed the undisclosed income.

The fair market value of any asset shall be determined in such manner as prescribed in the evaluation report to be transmitted quarterly to each House of the National Assembly as provided under Clause 22 of this Bill.

No deduction in respect of any expenditure or allowance shall be allowed against the income in respect of which declaration under Clause 2, is made.

3. Tax on Undisclosed Income: -

Not withstanding anything contained in the Income Tax Law or in any law, the undisclosed income declared under the Bill within the time specified therein shall be chargeable to tax at the rate of 30% of such undisclosed income (Clause 3(1)).

The amount of such a tax chargeable shall be increased by a surcharge, calculated at the rate of 25% of such tax to contribute to the Agricultural Research Council of Nigeria and Nigerian Infrastructure Fund, towards fulfilling government’s commitment to agricultural and economic development.

4. Investment of Declared Amount from Undisclosed Income:

The amount of undisclosed income declared under Clause 3(1), after tax and surcharge shall be invested within Nigeria by the declarant in any sector of the Nigerian economy and in accordance with regulations set under Clause 19.

Clause 19 provides that the Central Bank may by regulation set a time frame within which a declaration is made; provided that where the declaration is made after the lapse of time, the declarant shall not be entitled to economic amnesty.

5. Declaration of Investment: -

The amount declared from the undisclosed income (after payment of tax and surcharge in respect of declaration) shall be invested in any sector within Nigeria (Clause 4). The declarant shall invest in the economy in accordance with regulations under Clause 22 of this Bill.

“Clause 22 of the Bill provides that the Central Bank shall transmit quarterly to the each House of the National Assembly, a report on the evaluation of the scheme and the evaluation report shall include particulars of assets and funds declared, total amount of tax and surcharge recovered…”

6. No Penalty for Declarant: -

Not withstanding any provision in any law, the person making such a declaration shall not in addition to the tax and surcharge be liable to any other penalty (Clause 5).

7. Manner of Declaration: -

A declaration shall be made to the Chairman of the Federal Inland Revenue Service and shall be in such form and be verified in such manner as prescribed under Clause 19 of this Bill (Clause 6).

Clause 19 provides that the Central Bank may by regulation set time within which such declaration shall be made; provided that where the declaration is made after the lapse of time, the declarant shall not be entitled to economic amnesty thereof.

The declaration shall be signed by:

- The declarant himself (where the declarant is an individual);

- His solicitor (where the individual is absent from Nigeria);

- Any person duly authorized by him in his behalf

- The guardian or any other competent person (if the declarant is mentally incapacitated)

Where the declarant is a family, any adult member of such family may sign; where the declarant is a company, the Managing Director may sign or any director in the absence of the Managing Director. Where the declarant is a firm, the managing partner may sign or any other partner not being a minor if the managing partner is unable to sign.

Where the declarant is an association, any member or principal officer of the association may sign.

8. Prohibition to Make Another Declaration: -

Under Clause 6(3) any person who has made a declaration under Clause 3(1) of this Bill in respect of his income or as representative in respect of the income of any person, shall not be entitled to make any other declaration under that same provision in respect of his income or the income of such other person. If any such declaration is made, it shall be void

9. Payment of Tax and Surcharge: -

The tax and surcharge payable in respect of undisclosed income shall be paid on or before a date to be notified by the Federal Government in the official Gazette. The declarant shall file the proof of payment of tax and surcharge on or before the date notified.

If the declarant fails to pay the tax, surcharge in respect of the declaration made, on or before the date specified, the declaration filed by him shall be deemed never to have been made under the Scheme.

10. Exclusion of Declared Income under the Income-Tax Law: -

The amount of undisclosed income declared under the provisions of this Bill (when it becomes law) shall not be included in the total income of the declarant for any assessment year under the Income-Tax Law, if the declarant made the payment of tax and surcharged provided under Clause 3 of the Bill.

11. Undisclosed Income: -

A declarant under this scheme shall not be entitled in respect of undisclosed income declared, or any amount of tax and surcharge paid thereon, to re-open any assessment, reassessment made, or claim any set off or relief in any appeal, reference or other proceeding assessment or reassessment in relation to any such of undisclosed income declared.

12. Undisclosed Assets: -

The provisions of this Bill (when it becomes law) shall apply to transactions where a property is held by or transferred to a person, but has been provided for or paid for by another person. The provisions of this Bill shall apply to property transactions where the transaction is made in a fictitious name, the owner is not aware or had denied knowledge of the ownership of the property, or the person who provided the consideration for the property is not traceable.

The provisions of this Bill shall apply in respect of the declaration of undisclosed income made in the form of investment in any asset, if the asset existing in the name of another, is transferred to the declarant, being the person who provides the consideration for such asset, or his legal representative, within the period specified by the Central Bank of Nigeria.

13. Non-Refundable Tax: -

Any amount paid as tax and surcharge as provided under this Bill shall not be refundable (Clause 11)

14. Inadmissible Evidence: -

Any declaration made in accordance with this Bill shall not be admissible in evidence against the declarant for the purpose of any proceeding relating to prosecution or imposition of penalty (other than the tax and surcharge) or jail sentence, except in matters of national security.

The Bill states that in “matters of national security”, the facts and issues have to be determined by a court of competent jurisdiction before effect is given to the exception.

15. Misrepresentation of Facts: -

Notwithstanding anything contained in this Scheme, where a declaration has been made by misrepresentation or suppression of facts, such declaration shall be void and shall be deemed not to have been made under this Scheme.

16. Exemption from further Assessment: -

Where the undisclosed income is represented by cash (including bank deposits), bullion, investment in shares or any other assets: -

- Which have not been declared in any return form furnished by him for the said assessment year or years; notwithstanding anything contained in any law or any rules;

- In respect of which the declarant has failed to furnish a return under any law in operation, for the assessment year commencing on or before this Bill becomes law;

Such assessment shall not be payable by the declarant in respect of such assets and such assets shall not be included in his net-worth for the assessment period of time.

17. Remittances of Foreign Assets: -

Where the undisclosed income is represented in foreign bank deposits, foreign investment or any other assets outside Nigeria, requiring remittance from outside Nigeria:

- No declarant who claims immunity in accordance with this scheme shall be required to disclose, for any purpose whatsoever, the nature and source of the remittance made to him;

- No inquiry of investigation shall be commenced against the recipient under any such law on the ground that he has received such remittance;

- The fact that the recipient has received a remittance shall not be taken into account and shall be inadmissible as evidence in any proceedings relating to any offence or the imposition of any penalty under any law (Clause 15).

Nothing under Clause 15 of the Bill shall apply in relation to any foreign exchange, to be brought into Nigeria under the provisions of Money Laundering Act, the Income-Tax Law or Exchange Regulation Law applicable in Nigeria.

Nothing under this Bill shall apply in relation to any foreign exchange, to be brought into Nigeria under any prosecution for any offence punishable Nigeria Penal/Criminal, Laws on the Narcotic/drug and substances, and laws for prevention of corruption.

18. Avoidance of Doubts -

Save as otherwise expressly provided under this Bill (when passed into), nothing in the Scheme shall be construed as conferring benefit, concession or immunity on any person other than person(s) making the declaration under the Scheme.

Where a declaration has been made and no tax or surcharge was paid within the specified time, the undisclosed income shall be chargeable to tax under the Income-tax Law in the previous year in which such declaration is made.

19. Power to Remove Difficulties:

If any difficulty arises in giving effect to the provisions of the Scheme, the Federal Government may, by order, not inconsistent with the Scheme, remove the difficulty; provided that no such order shall be made after the expiry of the date on which the provisions of the Scheme shall come to an end (Clause 17).

Every order made under this Clause shall take effect until such order is laid before each House of National Assembly and approved. Provided that where National Assembly fails to act on the order after 30 days of its being laid, the order shall immediately come into effect and become applicable.

20. Automatic Amnesty:-

A declarant shall be entitled to automatic amnesty, and the sources(s) of such money shall not be required (Clause 18).

21. Time frame for Declaration:-

The Central Bank may by regulation set time frame within which such declaration should be made; provided that where the declaration is made after the lapse of time, the declarant shall not be entitled to economic amnesty (Clause 19).

The Bank may by regulation, published in the official gazette further extend the set time frame for the application of the Bill.

22. Power to Make Regulations: -

The Central Bank Governor, by notification in the Official Gazette may make regulation for carrying out the provisions of the Scheme under the Bill (when it becomes law). Such regulations may provide for the form in which a declaration may be made, and every regulation under the Scheme shall be laid as soon as it is made, before both House of the National Assembly, while it is in session for a total period of 30 days.

Before the end of 30 (thirty) days, both Houses may do the following:

- approve the rules as it is;

- agree and make modifications in the rule; or

- agree that the rule should not be made

23. Quarterly Report:

The Central Bank shall quarterly transmit to each House of the National Assembly:

- a report on the evaluation of the Scheme;

- the evaluation report shall include particulars of assets and funds declared, total amount of tax and surcharges recovered;

- any other information as may be determined and required by the National Assembly;

- recommendations for improving implementation of this Bill (when it becomes)

CONCLUDING ISSUES

Voluntary Income Declaration, Recovery and Amnesty Scheme Bill seeks to harness untaxed money for investment purposes and to assure any declarant regarding inquiries and proceedings under Nigerian laws. The Bill requires that the undisclosed income declared within the time specified shall be chargeable to tax at the rate of 30% of such undisclosed income. The amount of tax chargeable shall be increase by a surcharge, calculated at 25% of such tax to contribute to the Agricultural Research Council of Nigeria and the Nigeria Infrastructure Fund, towards fulfilling the government’s commitment to agricultural and economic development (Clause 3).

Furthermore, the Bill requires that the undisclosed income (after payment of tax and surcharge under Clause 3) be invested in Nigeria by the declarant in any sector of the Nigerian economy. In addition, the declarant shall not be liable to any penalty after the payment of the tax and surcharge (Clause 5); and except in “matters of National Security”, no evidence against the declarant shall be admissible for any proceeding relating to prosecution, imposition of penalty or jail sentence.

Clause 18 stipulates that a declarant shall be entitled to automatic amnesty and sources of such income shall not be required. In effect, where a person declares an undisclosed income and pays tax and surcharge on it, such a person shall not be obligated to reveal the source of the income and cannot be prosecuted for it, even if the money was acquired illegally.

Amnesty for anyone who misuses public funds, loots the treasury or acquires income illegally may not reflect justice, but it is expected to ensure that such funds are repatriated back to Nigeria (if kept outside the country) and invested in Nigeria. Cases of corrupt officials who abscond with public funds will reduce, however impunity may increase if this Bill becomes law as it tends to limit will prosecution and sanctions (See Clauses 12 & 18). Passage of this Bill may do more harm than good in the fight against corruption in Nigeria.

Infographic: